Suppose Sham has bought goods from Ram on Credit of Rs. Of course we only pay 9800 in.

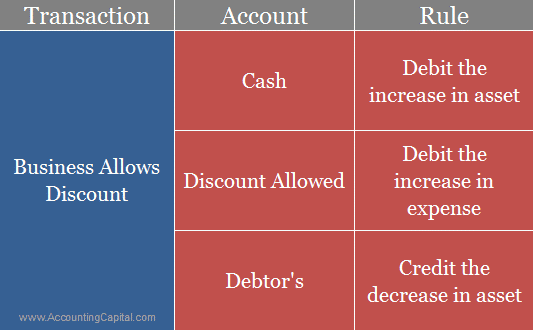

What Is The Journal Entry For Discount Allowed Accounting Capital

100 keyboards are sold for the invoice price of 300 each with payment terms 110 Net 30 days.

. 50000 on 1st jan. Settled the amount on 11 th Jan. Journal entry for a cash discount in this.

Due to the customer takes up the early payment. When at the time of sales or receiving cash any concession is given to the customers it is called discount allowed. In this case the company ABC Ltd.

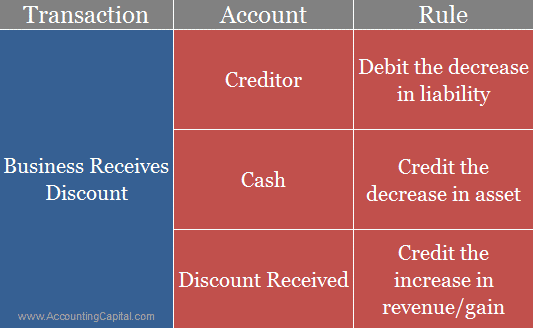

The full amount of purchase is 5000 and the company receives the 3 discount as it makes an early payment. Discount received on purchase example. Prepare the journal entries for.

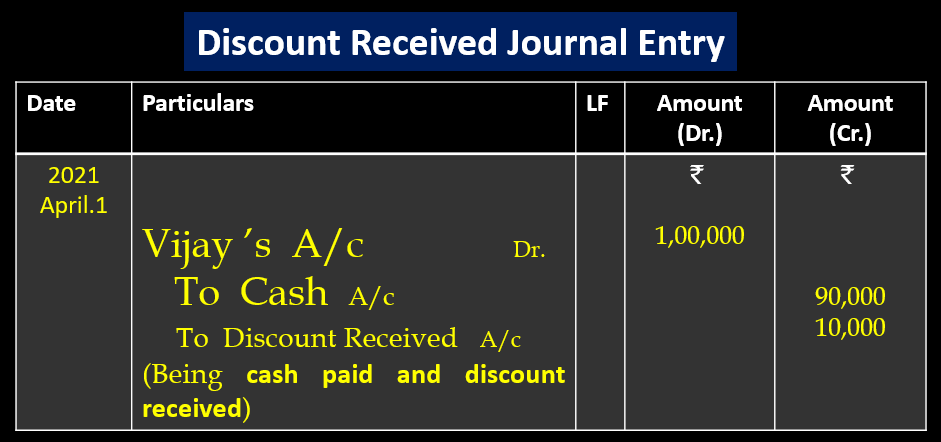

Discount received journal entry According to Traditional Approach Example- Vijay has to pay 100000. A cash discount received sometimes called an early. To Discount Received Ac.

The credit terms that are put forth by Blenda. Settled the amount on 8 th Jan. According to nature there are.

Party Creditors Ac Dr. Journal Entry for Discount Allowed and Received. 17 January 2008 Dear all.

On March 31 2019 for a sales price of 100000 with the terms 10 510 n30. Can make journal entry for the 1500 cash received on October 30 2020 as below. Likewise this purchase discount is also called cash discount and the company needs to properly make journal entry for it when it receives this discount after making payment.

So we received the discount we pass following journal entry. In this case the company ABC can make the journal entry for the discount. The exceptions to this rule are the accounts Sales.

Let us take the example of DFG Inc which sold merchandise to SWE Inc. Basically the cash discount received journal entry is a credit entry because it represents a reduction in expenses. Later on January 8 we receive this 200 discount as we make the cash payment for the 10000 credit purchase.

For example the company ABC receives the payment for the product it sold for 2500 on credit in the prior week. 2014 and it is the term of agreement that if. Journal Entry for Cash Discount.

In full settlement. Creditors account is a personal Ac Personal. A discount is a concession in the selling price of a product offered by a seller to its customers.

Journal entry for discount received is. A 2 cash discount on 500 is 10 and the amount of cash the business actually pays the supplier pays is 490.

Discount Received Journal Entry Bhardwaj Accounting Academy

Journal Entry For Discount Received Examples Tutorstips Com

What Is The Journal Entry For Discount Received Accounting Capital

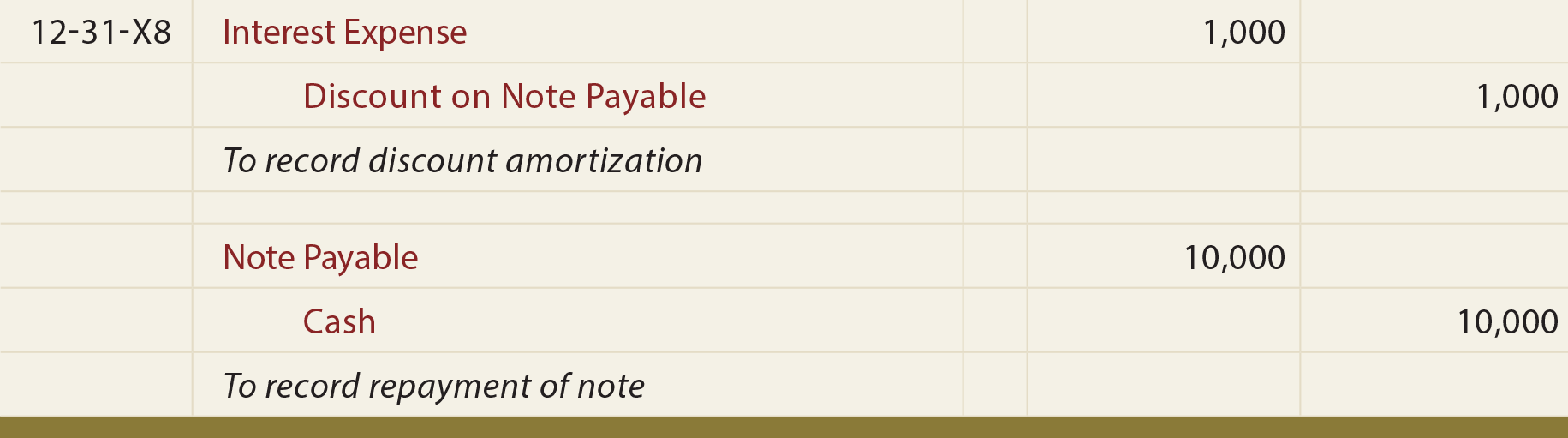

Notes Payable Issued At A Discount Principlesofaccounting Com

0 Comments